Make Money on Savings/Fixed Deposit Accounts.

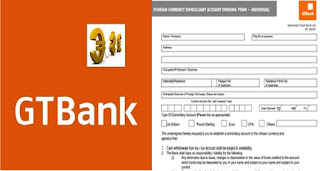

How to Open a Fixed Deposit Account

Fixed deposit account as the name implies is an investment account whereby the owner is meant to to save his or her money for some period of time and in returns earns interest according to the percentage of the amount in the account.For those who have some idle money that they may not need soon, this might just be an account that they should consider. It is not open to other risky investment options such as shares. It encourages savings culture because it will not allow the owner to withdraw the money at will.

A fixed deposit account ensures that a person definitely gets returns at the maturity date or the stipulated date of agreement with the bank.

A depositor can also open different types of fixed accounts with different maturity dates. Comparing the interest rates from different banks will help the depositor to choose the right bank for his fixed deposit.

SEE ALSO: How to Make 150,000 Naira Every Month in Nigeria

Special accounts

Different banks have introduced different banks accounts to woo customers and discourage them from making regular withdrawals from their accounts.A special account will also encourage bank customers to maintain a stipulated minimum balance in the account.

The features of the account include providing a reasonable high interest rate.

The special account also provides incentives to make the customer to save towards a specific target. Sometimes, the bank gives the depositor a bonus for maintaining a certain balance, usually within a year. It can also give the depositor access to loan facilities.

Savings accounts

Savings accounts allow the owners to withdraw money at any time either using their savings book, debit card or withdrawal book over the counter.It gives free options to access money than other types of accounts. Different banks have different savings accounts, which attract different interest rates. However, the rates paid on savings accounts are not usually high like fixed deposit account.

The best place to earn interest is in a Savings Account. Don't waste your time looking for a checking account with a decent interest rate.

Think of a savings account like a loan to a bank. Banks borrow that money and lend it to someone else. They make profit on the difference between what they pay to you for lending (close to 0%), and what they charge people to borrow (on credit cards, usually more than 15%). Nice business! But really, why give banks a 0% loan? Often it’s because of sticky retail deposits. That's the bank's term for account holders who put a lot of money in a savings account and never touch it. Fortunately, many online banks now offer up to 0.9%, and by using our simple rules, you can start earning better returns on your money.

Switch to a high-interest online savings account.

If you’re OK with moving money to a bank without branches, it’s possible to find accounts that pay 1% or more. You don’t have to necessarily close your existing savings accounts, but keep enough in them to avoid fees. Though some consumers may feel nervous about online banking, it’s becoming increasingly popular, and mobile apps make it very convenient. Rest assured that as long as your online bank is a member of the FDIC, your deposits of up to $250,000 are insured by the government.

Save and Earn

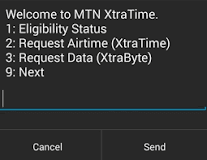

Its that easy with Savings Account you can start saving today with as little as ₦1, 000.Save your money.

Earn interest.

Get money from any ATM nationwide for free to spend on whatever you like.

Competitive interest rates. (Interest is forfeited if more than 3 withdrawals are made in a month)

So I will like to ask you readers, among Fixed deposit, special and savings account, which do you prefer?